ONITY GROUP (ONIT)·Q4 2025 Earnings Summary

Onity Group Q4 2025: $102-122M Tax Benefit Drives Record EPS as Operations Stumble

January 26, 2026 · by Fintool AI Agent

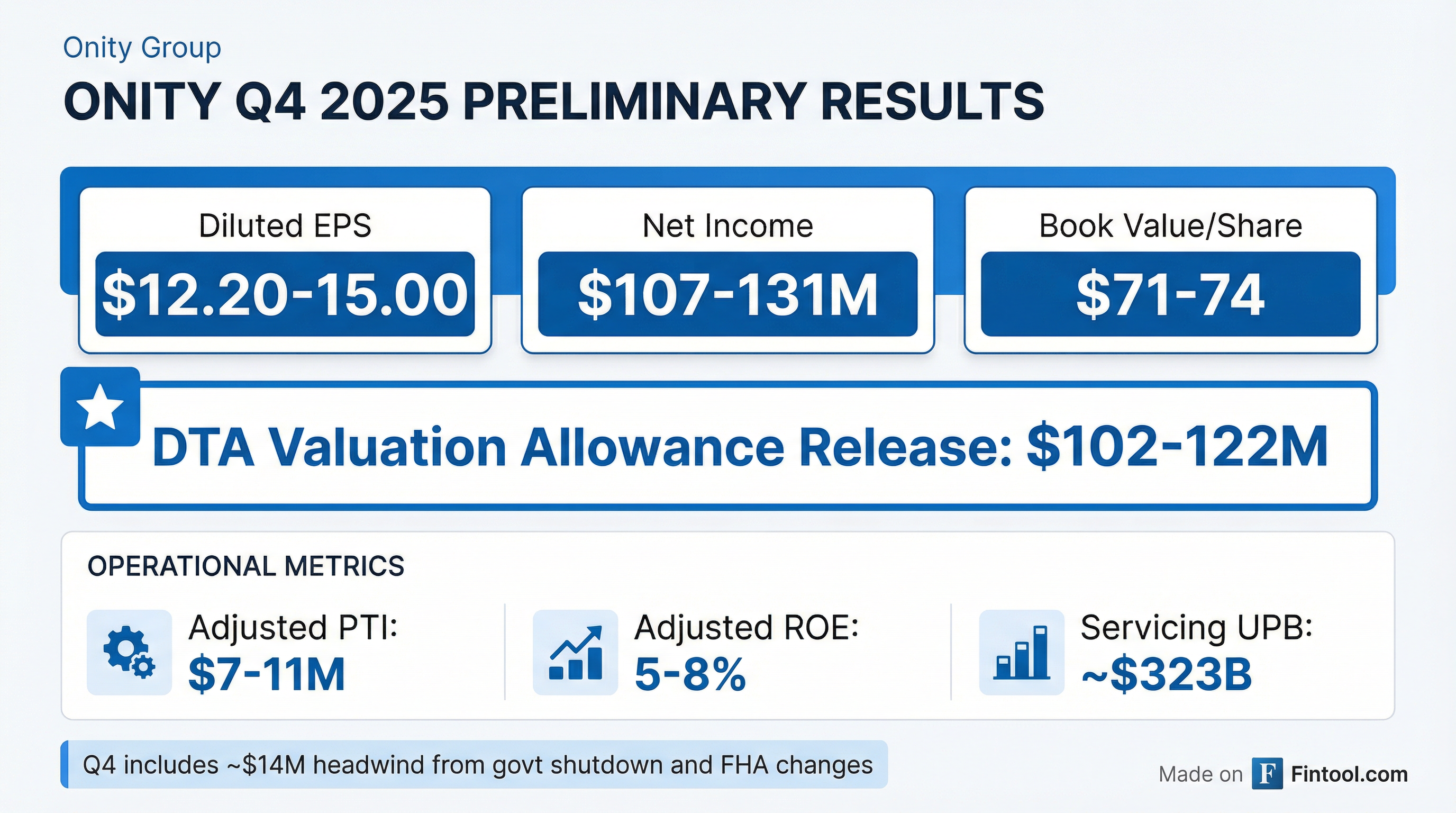

Onity Group (NYSE: ONIT) released preliminary Q4 2025 results today showing diluted EPS of $12.20-15.00, driven almost entirely by a long-anticipated deferred tax asset valuation allowance release of $102-122M. Stripping out the one-time tax benefit, the mortgage servicer reported adjusted pre-tax income of just $7-11M—the weakest operational quarter in over two years—due to headwinds from the government shutdown and changes to FHA modification programs.

The stock closed at $51.69 on the last trading day, up 130% from its 52-week low of $25.50.

Did Onity Beat Earnings?

The headline numbers are extraordinary, but context matters:

*Values retrieved from S&P Global

The $102-122M valuation allowance release accounts for nearly all of the net income. This was expected—management flagged a "reasonable possibility" of releasing some or all of the ~$180M VA by year-end 2025 during Q1 earnings.

The operating story is weaker: Adjusted pre-tax income of $7-11M includes an estimated $13-15M accelerated loss within the Servicing segment from the government shutdown and FHA modification program changes.

What Was the DTA Valuation Allowance Release?

This is the story that's been building for years. Here's how management explained it on previous calls:

"The total valuation allowance or VA for the U.S. DTA was about $180,000,000 at the end of '24 and using the twenty four year end share count would create an increase of roughly $22 per share."

The company had maintained a full valuation allowance against its deferred tax assets since 2015 following historical losses. Sustained profitability over recent years finally allowed the accounting reversal:

The release hits the income statement as a tax benefit, flows through to stockholders' equity, and improves leverage ratios.

Full Year 2025: Did They Hit Guidance?

Management guided to 16-18% adjusted ROE for 2025. They delivered:

Full-year GAAP net income of $166-190M and diluted EPS of $19.30-22.10 are both records, though dominated by the tax benefit.

What Changed From Last Quarter?

Negatives:

- Adjusted PTI dropped sharply: $7-11M vs ~$17-19M in Q3

- Government shutdown created $13-15M accelerated loss in Servicing

- FHA modification program changes hurt the loss mitigation business

- Adjusted ROE fell to 5-8% annualized from 13.8%

Positives:

- DTA release finally came through, adding ~$13-14 to book value per share

- Debt-to-equity ratio improved to 2.7:1-2.6:1 (3.2:1-3.1:1 excluding VA release)

- Consumer Direct funded volume of ~$800M with recapture rates exceeding industry averages

- Total origination funded volume ~$14B for Q4, ~$43B for full year

Capital Allocation: New $150M Note Offering

Alongside the earnings preview, Onity announced a $150M add-on to its 9.875% Senior Notes due 2029. Key details:

- Add-on to existing $500M issue from November 2024

- Senior secured, guaranteed by Onity and certain PHH subsidiaries

- Proceeds for general corporate purposes and debt repayment at PMC and PAS

This continues the capital structure optimization that management has prioritized, having completed a major debt restructuring in 2024 that "reduced both the level and average effective cost of our corporate debt, extended the maturity and simplified the structure."

Historical Financial Performance

*Values retrieved from S&P Global

Management Credibility Check

Onity has delivered on its key commitments:

✓ Adjusted ROE guidance: Guided 16-18% for 2025, delivered 16-17% ✓ DTA release timing: Flagged "reasonable possibility" by year-end 2025, delivered ✓ Servicing growth: Grew UPB consistently through 2025 ✓ Recapture improvement: "Refinance recapture performance at levels equal to or better than several of our larger and more mature peers"

The one miss: Q4 operations were clearly weaker than expected, though management attributes this to external factors (government shutdown, FHA changes).

What to Watch Going Forward

- Q4 Earnings Call: Management will need to detail the government shutdown impact and whether it's truly one-time

- 2026 Guidance: Will likely come at the full earnings release—key question is whether 16-18% adjusted ROE is sustainable

- Interest Rate Sensitivity: With ~$323B servicing UPB, rate movements remain the biggest swing factor

- Industry M&A: Management has cited the Rocket-Mr. Cooper deal as potentially accelerating consolidation opportunities

The Bottom Line

Onity's Q4 2025 is a tale of two stories. The headline—record EPS of $12-15—is almost entirely a one-time tax benefit that was well-telegraphed by management. The underlying operations disappointed, with adjusted PTI of $7-11M representing the weakest quarter in over two years.

Still, full-year 2025 delivered: adjusted ROE within guidance, book value up ~25% to $71-74, and the long-awaited DTA release that improves the balance sheet and debt ratios going forward. For a stock that's doubled from its lows, the question is whether the operational stumble in Q4 is temporary or a sign of tougher sledding ahead.

Note: Q4 2025 results are preliminary and unaudited. The company has not completed financial closing procedures. Actual reported results may differ materially.